BizChina

- Details

- By David Cao

- Hits: 1690

Supervision of the investment of China's pension fund has become a more important issue than the pension system itself, Zheng Gongcheng, professor of Renmin University of China, said at a seminar Tuesday, the 21st Century Business Herald reported.

Pension fund-related issues, such as the investment operation of personal accounts, the social security fund and enterprise annuities began to get more attention amid expectations of inflation and worries that the fund may be devalued, the report said.

One of the reasons is that the earnings of the fund could not catch up with the rise of consumer prices for a long term, which led to huge losses on the account, the paper reported.

According to current regulations, China's national pension fund is only allowed to be deposited in banks or used to purchase treasury bonds. After subtracting the inflation rate, the average interest rates on personal-account funds invested in one-year bank deposit, three-year bank deposit and three-year treasury bonds are -0.11 percent, 0.73 percent and 1.25 percent respectively.

- Details

- By David Cao

- Hits: 1534

China will continue to lead the global initial public offering (IPO) market in terms of the funds raised and the number of deals, international accounting firm Ernst & Young said in a report on Tuesday.

Mainland companies dominated the global IPO market by raising $188 billion in 495 deals on the top four bourses - New York Stock Exchange, Nasdaq Stock Market, London Stock Exchange and Hong Kong Stock Exchange - in the past decade, the report said.

"China will maintain its lead in the IPO market as more mainland companies tap overseas capital pools even as they expand their business locally," said Terence Ho, strategic growth markets and China IPO leader at Ernst & Young.

Hong Kong remains the main choice for mainland companies as a listing destination, while American bourses are the choice for small and high-growth information technology companies, Ho said.

Read more: Chinese firms raise $32.1b from domestic, overseas floats in H1

- Details

- By David Cao

- Hits: 1423

East China's Jiangsu province bought 192,000 tons of cotton from abroad in the first five months of this year, up 280 percent from the same period last year, according to the provincial customs.

The imports were valued at $330 million, up 420 percent, with the average price up 39.1 percent to $1,700 per ton.

Of the total imports, 50.2 percent, or 96,000 tons, were bought from India, up 870 percent.

- Details

- By David Cao

- Hits: 1708

American economists are urging the Chinese government to strengthen efforts to spur domestic consumption in order to help ensure the sustainability of China's economic growth and maintain the balance of trade.

While applauding the efforts China has made in transforming from an export-orientated to a consumption-led economy, academics and senior researchers from the United States said there is still a large gap for the world's most populous nation to fill to bring domestic consumption into full play.

"An increase in consumption is for China's growth, and an increase of consumption helps reduce global imbalances," said Rachel Ziemba, a senior economist on China issues with Roubini Global Economics.

Read more: Economists urge China focus on domestic consumption

- Details

- By David Cao

- Hits: 1525

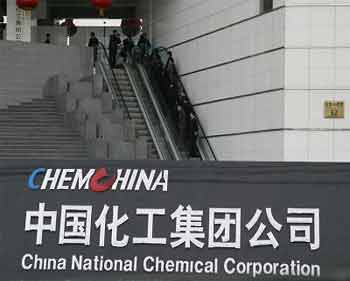

ChemChina is one of the top chemicals producers in China but "aims to be among the best in the world," said Ren Jianxin, president of China National Chemical Corp (ChemChina).

ChemChina is one of the top chemicals producers in China but "aims to be among the best in the world," said Ren Jianxin, president of China National Chemical Corp (ChemChina).

This year the company aims to increase its revenue by 22 percent to 139.5 billion yuan in 2010. It also plans to make profits of 3 billion yuan this year, up 173 percent from a year earlier, said Ren.

The company is already doing very well. It ranks second in the world for its production of methionine, and third for its production of organic silicon.

The company is currently expanding its Xinghuo organic silicon project in Jiangxi province, which is expected to be the world's largest production facility of the material.

Humble beginnings

Today ChemChina ranks 28th in China's top 500 enterprises, and it is 19th in the world's 100 leading chemical companies.

The company was started 26 years ago with loans of only 10,000 yuan. In 1984 Ren founded Bluestar Co to start his industrial cleaning business. Several years later Bluestar dominated China's industrial cleaning industry. In 1995 the company moved its headquarters from Lanzhou to Beijing, and one subsidiary, Bluestar Cleaning, was listed on the Shanghai Stock Exchange.

Since that year Ren began to eye other businesses and in 1996 Bluestar merge with Xinghuo Chemical Co, a manufacturer of organic silicon. Following the purchase of Xinghuo, Bluestar made many other acquisitions on the domestic market and by 2002 the company's total assets increased to 4 billion yuan.

In 2004 Bluestar, together with China Haohua Chemical (Group) Corporation, and some other chemical companies formed ChemChina, the biggest chemical producer in the country.

"We are now focusing on the development of new materials and specialty chemical products," said Ren. "Improvement in technology will play a vital role in achieving this target."

Overseas expansion

ChemChina has made a series of overseas acquisitions in the past few years. In 2006 the company acquired French company Adisseo, a firm specializing in producing methionine, vitamins and biological enzymes. In the same year ChemChina bought another French company Rhodia's organic silicon business.

After the acquisitions the company boosted its production of methionine to number two in the world and organic silicon production to the top three.

In 2007 ChemChina signed an agreement with US private equity Blackstone Group, under which the US company will invest up to $600 million in ChemChina's subsidiary Bluestar for a 20 percent stake.

These acquisitions not only boosted some of ChemChina's business into those with global competency, but also improved the company's technologies a lot, said Ren.

With the acquisitions ChemChina has got many patents with its own intellectual property (IP). The company now ranks among the best in terms of numbers of IP among enterprises owned by China's central government.

More Articles …

Page 63 of 125