BizChina

- Details

- By Btimes.com.my

- Hits: 1391

China Shipping Container Lines Co, the country's second-biggest box carrier, plans to almost double rates on Asia-Europe routes next month to help offset possible losses on weakening demand.

"Companies will raise rates, not because the market has recovered, but because the shipping lines have the resolution to do this," managing director Huang Xiaowen said. "We have found that if we cut rates, load factors don't increase." The company's Hong Kong-listed stock rose the most in almost a month.

The busiest season for sea-cargo box carriers traditionally starts July 1, when rates go up as European and US retailers stock up for the back-to-school and holiday shopping periods. Costs for shipping goods have fallen in the past year, partly because retailers are paring orders on weak consumer spending. China Shipping will increase rates to as much as US$650 (US$1 = RM3.54) per 20-foot container, Huang said.

"It's the only period when they have any chance of making money this year," said Jack Xu, an analyst at Sinopac Securities Asia Co in Shanghai. "Still, rates are so low, I doubt that's going to happen."

China Shipping will raise prices by as much as US$300 per 20-foot container from July 1, Huang said in Shanghai on Thursday.

"This peak season is going to be very short," China Shipping chairman Li Shaode said in an interview in Shanghai on Thursday. Analysts tracked by Bloomberg covering the shipping line expect it to make a full-year loss. The median estimate is a 2.4 billion yuan deficit.

The container line's stock jumped 9 per cent to HK$2.10 (HK$100 = RM45.64) in Hong Kong trading, boosting its gain this year to 79 per cent, compared with a 29 per cent increase for the benchmark Hang Seng Index.

China Shipping will also raise rates on its Asia-South America routes by US$300 per 20-foot equivalent unit, or TEU, Huang said. Rates on Middle East, Australia and Mediterranean routes will also go up, he added.

MISC Bhd, Asia's second-biggest shipping company market value, last month said it would stop operating Asia-Europe container shipping services from next year to focus on intra-Asian and Asia-Middle East services.

Container lines have parked ships and delayed deliveries of new vessels to curb excess capacity. Shipping lines are also trying to delay deliveries of new vessels to ease a capacity glut.

"Overcapacity damps the industry's overall recovery," said Li, China Shipping's chairman. "The industry will continue to suffer from overcapacity in the coming two to three years."

- Details

- By Chinadaily.com.cn

- Hits: 1805

Outbound investment of Chinese enterprises may be expanded as China's foreign exchange regulator said on Monday that it plans to simplify examination and approval procedures for domestic companies' investment abroad.

The State Administration of Foreign Exchange (SAFE) posted Monday on its website a draft regulation on foreign exchange management involving domestic enterprises investing abroad, to solicit public opinions.

According to the draft, domestic companies will be allowed to register the source of their foreign exchange financing after their investment overseas instead of obtaining approval beforehand.

The draft regulation also allows domestic enterprises to seek financing from more sources, including domestic foreign exchange loans, purchasing foreign exchange with yuan, the foreign currency funds enterprises possess, and their profits gained abroad.

The SAFE will also improve its supervision over overseas investment by carrying out annual inspection on investment projects together with the Ministry of Commerce, said the draft.

The draft regulation is aimed at facilitating and encouraging Chinese companies to invest abroad, and standardizing management of foreign exchange involved in such investment, said SAFE in an announcement which came along with the draft.

The SAFE is asking for opinions on the draft before June 19.

China's outbound direct investment reached $55.6 billion in 2008, up 194 percent from a year earlier.

- Details

- By David Cao

- Hits: 1541

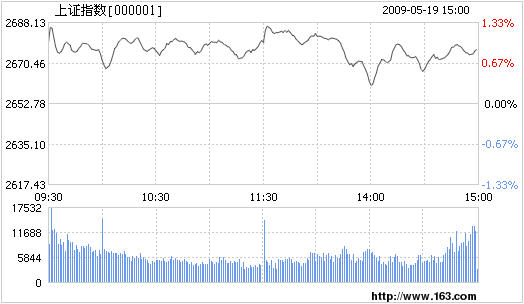

Chinese shares continued the upward trend for the third consecutive trading day and gained 0.9 percent Tuesday, driving the benchmark Shanghai Composite Index to a 9-month new high.

The Shanghai Composite Index edged up 0.9 percent, or 23.9 points, to close at 2,676.68 Tuesday.

The Shenzhen Component Index went up 1.07 percent, or 110.32 points, to 10,424.36.

Gains outnumbered losses by 544 to 278 in Shanghai and 435 to 273 in Shenzhen.

Combined turnover expanded to 227.97 billion yuan (33.4 billion U.S. dollars) Tuesday from 180.19 billion yuan on the previous trading day.

- Details

- By Daniel Gross

- Hits: 1661

For nearly 150 years, American businesspeople have been entranced by the possibilities of China—an unimaginably huge, virgin market. If only the Middle Kingdom were to develop into a thriving consumer society, it would be an incredible playground for American brands and companies—bigger and more profitable, potentially, than the U.S. domestic market. (See Thomas McCormick’s The China Market for an excellent history of this idea.) It hasn't quite worked out. Revolutions, communism, state control of the economy, enduring poverty and the tendency of the Chinese to save rather than spend have all proven to be formidable obstacles.

The Chinese operations of many American companies are still dwarfed by their massive domestic operations. Wal-Mart, for example, had 246 stores in China as of March 31, serving just 7 million Chinese customers weekly—a tiny portion of the population. But now, thanks to macroeconomic upheaval in the U.S. and China, the promise of the China market finally seems to be within reach. Exports to China are up about 25 percent in the first quarter of 2009 from 2008, but they're still tiny, just $5.5 billion in March. More significant has been the rapid growth of U.S.-branded products that are made and marketed in China.

Exhibit A: The Wall Street Journal reported today that Citigroup made far more money in China last year than it did in the U.S. That's not saying much, since Citi notched a $27.68 billion loss in 2008, mostly from its U.S. operations. But as James Areddy reports, the bank's "net income in China jumped 95 percent in 2008 to the equivalent of $191 million, helped by a 20 percent rise in commercial foreign-exchange transactions."

Exhibit B. General Motors. In April, GM sold 173,007 vehicles in the U.S., down 34 percent from April 2008. The same month, GM's China sales jumped 25 percent to a record 151,084. It's always dangerous simply to forecast by extrapolation, but the trends are undeniable. If GM's monthly China sales increase 7 percent from current levels and the carmaker's U.S. monthly sales decrease by 7 percent from current levels, then GM—more accurately, GM and its joint-venture partners—will be selling more cars in China than in GM's home country.

Exhibit C: YUM Brands, the parent of Pizza Hut, KFC, Taco Bell and Long John Silver's. Last year, YUM's restaurant count in the U.S. was basically unchanged. But its China unit, which comprises mainland China, Thailand and KFC Taiwan, opened 500 new restaurants and tallied operating profits of $469 million. With 2,980 restaurants and a new outlet opening almost every day, Yum Brands says KFC is the "largest and fastest growing restaurant chain in mainland China today." In the U.S., by contrast, the number of KFCs has fallen each of the last four years, from 5,525 in 2004 to 5,253 in 2008. Sales data show that KFC's U.S. operations still outsell its Chinese operations, by a margin of $5.2 billion to $3.6 billion. But when you back out sales of franchisees, the stores owned by YUM brands in China sold $2.5 billion worth of greasy chicken goodness in 2008, compared with $1.2 billion for company-owned stores in the U.S.

For the near term, it looks as if these trends will continue, and not just because the U.S. market for banking, cars and fast food is mature and shrinking while the Chinese markets for those goods and services is immature and growing. We may also be witnessing some fundamental shifts in trans-Pacific consumer behavior. As Geoff Dyer writes in an excellent Financial Times article, China's savings rate was a stunning 50 percent of GDP in 2007. But the Chinese consumer is more cautious than cheap. "Many Chinese put a large chunk of their wages into bank accounts because they are worried about pensions, education expenses and—most of all—the prospect of a big hospital bill if a family member falls seriously ill," Dyer writes. Ironically, the same may be said of post-credit-boom Americans, who are socking away cash instead of buying stuff made in China. Thanks to the global slump, The New York Times noted, Chinese exports overall were off 22.6 percent in April. And in the first quarter of 2009, according to the Commerce Department, Chinese exports to the U.S. fell 10.8 percent from the 2008 first quarter.

To make up for lost exports and to keep all those factories humming, China's government is now focusing on ways to bolster domestic consumer spending. A key form of stimulus, Dyer writes, will be boosting the government's role in providing health care. China has an ambitious effort underway to build clinics and has pledged to cover 90 percent of the population with some form of health insurance by 2011. More than tax cuts or public works spending, the thinking goes, a stronger safety net could spur Chinese consumers to spend less and save more.

In other words, the fact that China's population may soon be insulated from some of the ill health effects of eating KFC and driving Buicks might free up more cash for middle-class workers in Shenzhen to eat more KFC and buy more Buicks.

- Details

- By Chinaview.cn

- Hits: 1753

China is advancing its study of plans to allow foreign companies to list on the Shanghai Stock Exchange and may work out preliminary arrangements as early as this year, industry sources said yesterday.

The country is expected to step up communications with other nations in the coming months on the development of an international board in the city after concluding a deal with Britain on Monday for further stock-market reform, the sources said.

"China agrees to allow qualified foreign companies, including United Kingdom companies, to list on its stock exchange through issuing shares or depository receipts in accordance with relevant prudential regulations," the two countries said in a joint statement issued on Monday.

The agreement, reached by Chinese Vice Premier Wang Qishan and British Finance Minister Alistair Darling following a meeting in London, is set to pave the way for large British companies like HSBC to sell shares in Shanghai.

HSBC said in a statement yesterday that it "would like to be the first foreign bank to list in Shanghai if the authorities allow," and is working toward that goal. It did not give a specific timetable for a stock sale in the city.

Peter Wong, executive director of HSBC subsidiary Hongkong & Shanghai Banking Corp, said earlier this month that a Shanghai listing would consolidate HSBC's brand influence and raise funds for expansion in the Chinese mainland market.

Two years ago, China started to consider permitting foreign companies to issue yuan shares to help boost the status of its fledgling stock market on the mainland. But the program has proceeded slowly as regulators worked to ease investor jitters over a stock glut.

Program revived

Read more: Plans moving forward to enable foreign firms to list in Shanghai

More Articles …

Page 119 of 125