Chinese equities rose for a seventh consecutive trading day Friday, led by heavyweights.

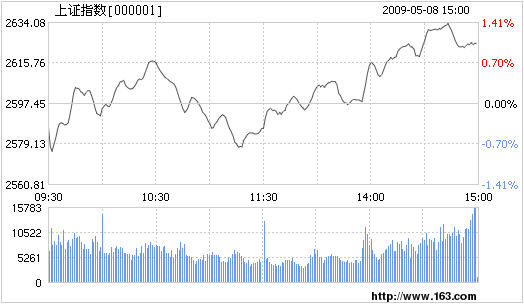

The benchmark Shanghai Composite Index rose 1.09 percent, or 28.2 points, to close at 2,625.65. The Shenzhen Component Index edged up 0.73 percent, or 74.12 points, to 10,183.06.

Gainers outnumbered losers by 474 to 408 in Shanghai, and 401 to 346 in Shenzhen.

Combined turnover shrank to 244.3 billion yuan (35.77 billion U.S. dollars) from 269.3 billion yuan on the previous trading day.

Oil producers' shares rose Friday on expectations that the government would raise benchmark retail prices for gasoline and diesel.

PetroChina, a subsidiary of the China National Petroleum Corp., the largest oil producer, rose 2.73 percent to close at 12.41 yuan. Sinopec was up 4.61 percent to 10.44 yuan.

Banking and real estate sectors performed strongly on talk that the central bank might cut the required reserve ratio, following the European Central Bank's decision to cut interest rates to 1 percent Thursday.

China Merchants Bank was up 6.07 percent to 17.29 yuan. The Industrial and Commercial Bank of China, the largest lender by market value, rose 1.87 percent to 4.36 yuan.

China Vanke, the largest property developer by market value, surged 7.89 percent to 9.84 yuan, while Dongguan Winnerway Industrial Zone, COFCO Property and Shenzhen Special Economic Zone Real Estate & Properties all rose by the 10-percent daily limit.

Share prices for Sichuan- and Chongqing-based construction companies also rose four days ahead of the May 12 earthquake anniversary. The government has poured resources into rebuilding damaged housing, schools and infrastructure in southwest China.

Sichuan Road & Bridge jumped by the 10-percent daily limit to close at 8.78 yuan, and Chongqing Road & Bridge surged 9.16 percent to 8.94 yuan.