BizChina

- Details

- By David Cao

- Hits: 992

The U.S. government will investigate charges against import of oil well drill pipe from Chinese companies, said the Commerce Department on Thursday.

The case, which was filed by the United Steelworkers union and a group of companies from Texas and Illinois, is the first U.S. trade probe of this year against China after about a dozen in 2009.

The petitioners have asked for anti-dumping duties ranging from 429 percent to 496 percent.

They also want additional countervailing duties to offset alleged government subsidies, the Commerce Department said.

The investigation covers heavyweight drill pipe and drill collars of iron or steel used to drill oil wells.

The Commerce Department said that the United States imported 194.6 million dollars worth of the drill pipe from China in 2008, up from 107.1 million dollars in 2006.

In this probe case, the U.S. International Trade Commission has to decide by mid-February whether there is a reasonable indication that U.S. companies have been injured or threatened with injury by the imports.

Read more: U.S. launches trade probe against Chinese drill pipe

- Details

- By David Cao

- Hits: 872

China's cruise economy kept growing as liner departures from and visits to Chinese harbors increased steadily in 2009, industry insider said Friday.

China Cruise and Yacht Industry Association told Xinhua Friday that China's cruise ship market will grow rapidly this year with liner visits expected to rise by a big margin. But it declined to reveal detailed predictions, only estimating that all-year cruise ship visits to Shanghai alone will reach 120 for 2010.

According to the association, cruise ship departures from China's coastal cities numbered 80 in 2009, a growth of 38 percent over the 2008 level; and cruise ship visits at such cities numbered 76. But the industry organization did not reveal the year-on-year change figure for the visits.

The association took Shanghai as an example. Last year the city recorded a 17-pecent year-on-year growth in number of international cruise ship visits and a 83-percent growth in number of human exits and entries by liners.

Read more: China to receive much more cruise ship visits this year

- Details

- By David Cao

- Hits: 973

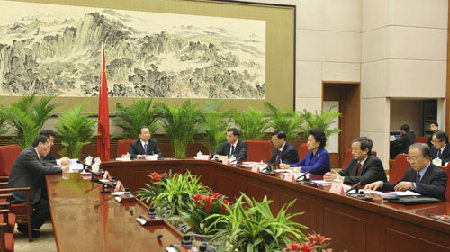

Chinese Premier Wen Jiabao (3rd L) presides over a plenary meeting of the State Council to discuss the draft of the government work report to be delivered at a national session of the country's parliament in Beijing, capital of China, Jan. 19, 2010.

Premier Wen Jiabao said Tuesday the acceleration of the adjustment of China's development pattern while maintaining steady and fast economic growth must run through all the government's work this year.

The government should incorporate speeding up the transformation of the development mode into maintaining steady and relatively fast economic development, Wen said at a plenary meeting of the State Council, or Cabinet.

At the meeting, a draft government work report, to be delivered at an annual national session of the country's parliament, was discussed.

The government must strengthen macro-economic control and carefully handle the relationship between maintaining steady and relatively fast economic development, adjusting economic structure and managing inflation expectations in a bid to create favorable conditions to transform the development mode, he said.

The government would stick to the policy of expanding domestic demand this year to boost public consumption and optimize the investment structure, he said.

Wen said the country should make "substantial progress" in transforming the economic development mode by continuing to push forward renovation of key industries, fostering strategic emerging industries, promoting accelerated development of the service sector, and improving the overall quality and competitiveness of the national economy.

The government would comprehensively implement its strategy of reinvigorating the country through science, education and expertise, and enhance its efforts to turn China into an innovation-oriented country so as to give technological and personnel support for the transformation of the development mode, he said.

The government should also make efforts to improve the people's living standards and deepen reforms of "key fields" to establish a system which was conducive to the transformation, he said.

- Details

- By David Cao

- Hits: 946

China's top appliance maker TCL Saturday started building a 8.5-generation LCD production line in the southern city of Shenzhen to meet the rising demand for flat-screen TVs.

The plant, in which TCL and Shenchao Technology Investment Company each hold a 50 percent stake, involves an investment of 24.5 billion yuan ($3.6 billion). It covers an area of 600,000 sq m.

The fund includes 10 billion yuan from TCL and Shenchao, bank loans and also investment from domestic TV makers and overseas LCD panel producers, the two investors said.

Read more: TCL starts to build $3.6b 8.5G LCD production line

- Details

- By Taylor Buley

- Hits: 1005

When Google recently disclosed an attack originating from China targeting more than 20 U.S. technology companies, the company revealed only that the attack was "highly sophisticated and highly targeted." On Thursday McAfee announced that it found at least one of the technological footholds for the attack: a previously unknown vulnerability in Microsoft's Internet Explorer browser.

Targeted attacks using unpublished vulnerabilities in browsers are nothing new, especially for companies like Google with valuable intellectual property to protect. In fact, what may be most striking about the so-called "Aurora" exploit is just how old the attackers' target was.

As hundreds of browser bugs have been exposed and patched over the last decade, browser attacks like the one Aurora used are considered by some cybersecurity researchers to be on the wane compared with trendier targets like PDF readers, browser plug-ins and other complex applications, says Ed Skoudis, a cybersecurity researcher with IntelGuardians. That's because programs like Internet Explorer have been probed for vulnerabilities for years and patched repeatedly, while programs like Adobe Readers are just starting to be targeted by hackers.

Cybersecurity researchers publicized 30 new bugs in Internet Explorer last year, compared with 49 in 2007 and 90 in 2006, according to iDefense, the security division of Verisign. That compares with 45 bugs in Adobe Acrobat last year, up from a mere four in 2006. Those kinds of statistics appeared to show that Internet Explorer was being hardened over time as various bugs were exposed and patched, Skoudis says.

More Articles …

Page 75 of 125